Before you use a home addition value calculator, it’s crucial to grasp its limitations. These tools often generate estimates based on algorithms that may overlook unique aspects of your property or specific market conditions. Understanding what influences home value can help you interpret these estimates more accurately. However, there’s much more to reflect on, especially regarding the impact of quality and local trends. Let’s explore these factors further to make certain you make informed decisions.

Key Takeaways

- Home addition value calculators provide estimates, but results may not reflect local market conditions or unique property features.

- Understand that not all calculators are equal; choose reliable tools with accurate algorithms for better estimates.

- Professional appraisals offer a more precise assessment than calculators, considering factors like location and property condition.

- Cross-reference calculator results with comparable sales data to validate estimates and ensure informed decision-making.

- Use calculators as a starting point, but combine their insights with local market research and professional advice for better investment outcomes.

Understanding Home Value Basics

When you consider adding to your home, it’s essential to understand the fundamentals of home value.

Home equity represents the difference between your property’s market value and what you owe on your mortgage. This equity can greatly impact your overall financial health.

Additionally, when evaluating your home’s investment potential, think about how an addition can enhance both livability and resale value. A well-planned addition not only increases your home equity but also attracts buyers in the future.

Consider how a thoughtful addition can boost your home’s livability and future resale value.

Evaluating these factors helps you make informed decisions, ensuring that your investment yields the best returns in the long run.

Factors That Influence Home Value

Although various factors contribute to home value, understanding the key elements can empower you to make strategic decisions about your property.

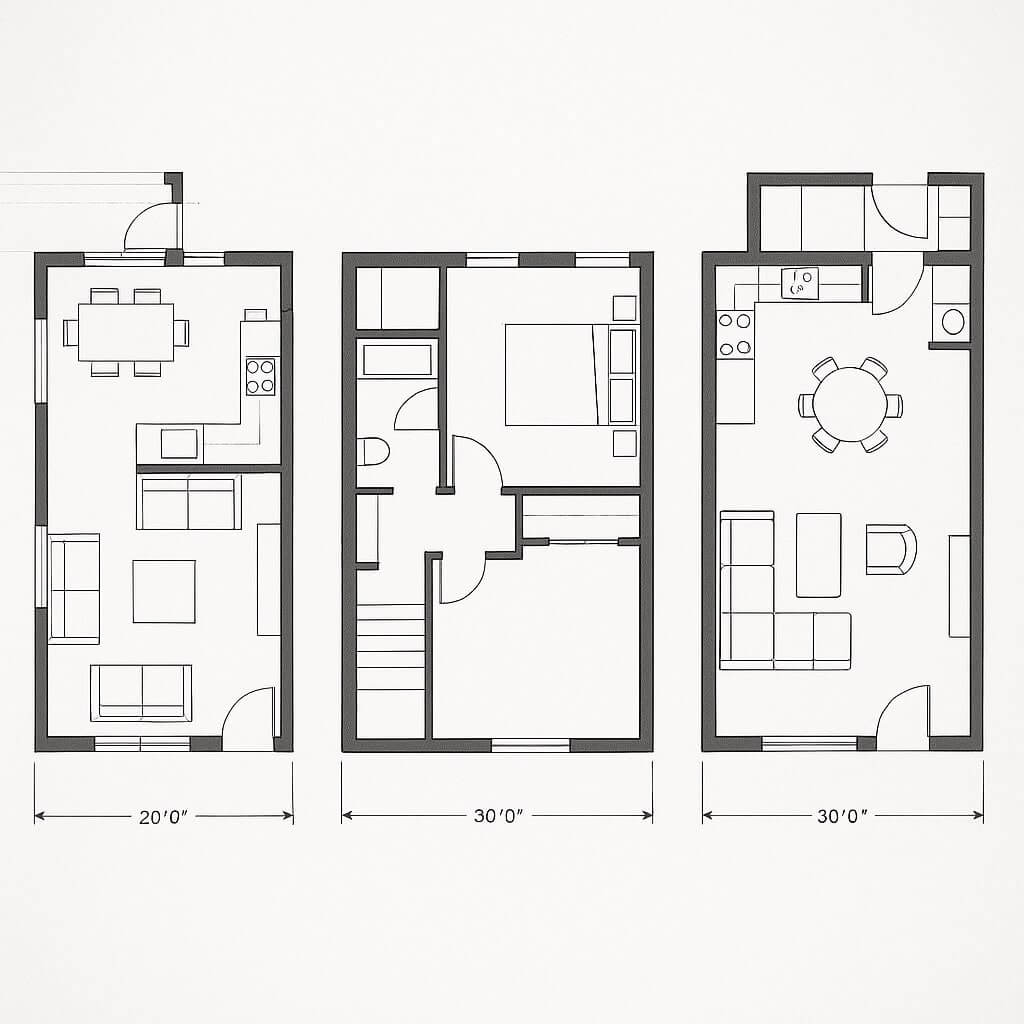

Property features play a significant role; upgrades like modern kitchens, energy-efficient appliances, and additional bathrooms can enhance your home’s appeal.

Additionally, the quality of materials used in renovations directly affects overall value.

Renovation costs must be carefully considered, as high expenses without proportional increases in home value can lead to financial losses.

Balancing desirable property features with reasonable renovation costs guarantees that your investment yields the best possible returns in the competitive real estate market.

The Role of Location in Home Appraisal

When appraising a home, location markedly impacts its value, influenced by neighborhood market trends and comparisons to similar properties.

You’ll find that homes in desirable areas often appreciate more rapidly due to demand.

Understanding these factors is vital for making informed decisions about your home addition’s potential return on investment.

Neighborhood Market Trends

Understanding neighborhood market trends is essential for accurately appraising a home’s value, as the surrounding area greatly influences buyer perceptions and demand.

Pay attention to market demand in your neighborhood, as fluctuations can affect how much your home addition will increase overall value.

Consider the neighborhood amenities, like parks, schools, and shopping centers, as these factors enhance desirability and can drive up prices.

Research recent sales in the area to gauge how similar homes fared and what buyers are willing to pay.

Ultimately, a well-informed perspective on these trends can greatly impact your home addition’s return on investment.

Property Value Comparisons

Location plays an essential role in property value comparisons, often determining how much a home addition can boost your overall investment. Proximity to amenities, schools, and parks greatly influences valuation. Additionally, local market trends and demand impact how features and aesthetic improvements are perceived.

| Property Features | Aesthetic Improvements |

|---|---|

| Size of the addition | Modern design elements |

| Energy-efficient upgrades | Landscaping enhancements |

| Quality of materials | Interior finishes |

| Accessibility features | Outdoor living spaces |

| Smart home technology | Curb appeal enhancements |

Understanding this landscape is vital for maximizing your home’s potential.

Evaluating Market Trends and Their Impact

To maximize the value of your home addition, you need to understand local market conditions and how they influence property values.

Analyzing comparable properties nearby gives you insights into what buyers are willing to pay, guiding your design and budget decisions.

Additionally, timing your addition project can greatly impact your return on investment, as market fluctuations can either enhance or diminish your home’s appeal.

Understanding Local Market Conditions

While evaluating your home addition’s potential value, it’s important to take into account local market conditions, as they can greatly influence property prices and buyer preferences.

Analyzing market demand in your area provides insight into how many buyers are actively seeking homes like yours. Keep an eye on economic indicators such as employment rates and inflation, as these factors often dictate buyer confidence and purchasing power.

Understanding these elements helps you gauge the timing and feasibility of your addition, ensuring you make informed decisions that align with current market trends. This strategic approach can enhance your investment’s overall value.

Analyzing Comparable Properties Nearby

When evaluating your home addition, it’s crucial to analyze comparable properties nearby, as this can provide valuable insights into market trends and their potential impact on your investment.

Start by reviewing recent comparable sales in your area, focusing on properties with similar features, such as square footage, number of bedrooms, and amenities. This data allows you to gauge the market value of your addition.

Pay attention to how these comparable properties are priced and the features that attract buyers. Understanding these aspects will help you make informed decisions and maximize the return on your investment when adding to your home.

Timing Your Addition Project

Understanding the timing of your addition project is essential, as market trends can greatly influence both costs and potential resale value.

Your project timeline should align with peak seasons for construction, typically spring and summer, when demand is high, and contractors are readily available.

Conversely, winter months may offer lower labor costs but can disrupt your schedule due to weather challenges.

Keep an eye on local real estate trends; rising property values can enhance your investment.

Quality of Materials and Construction

The quality of materials and construction plays an essential role in determining the value of a home addition. High material quality guarantees durability and aesthetic appeal, while adherence to construction standards assures safety and compliance with local regulations.

When evaluating your addition, consider how these factors influence overall market value. For instance, using premium materials can yield a higher return on investment compared to budget options.

Additionally, employing skilled labor to meet construction standards enhances the structural integrity and longevity of your addition, ultimately impacting its resale potential.

Prioritizing quality in both materials and construction can greatly boost your home’s value.

Importance of Professional Appraisals

Quality materials and skilled construction set a strong foundation for your home addition, but to accurately gauge its value, professional appraisals are invaluable.

Relying solely on home addition value calculators can lead to misleading conclusions. Professional appraisers provide essential insights, taking into account various factors like location, market trends, and property condition. Their expertise guarantees appraisal accuracy, helping you understand the true worth of your investment.

Furthermore, appraisers can identify unique features and improvements that calculators may overlook. In short, involving a qualified appraiser safeguards your financial interests and enhances your understanding of your home addition’s market value.

Common Misconceptions About Value Calculators

While many homeowners turn to value calculators for quick estimates, several misconceptions can lead to unrealistic expectations. It’s essential to understand that calculator accuracy varies greatly based on data input and market conditions. Here’s a breakdown of common misconceptions:

| Misconception | Reality | Impact on User Expectations |

|---|---|---|

| They’re always accurate | Accuracy depends on local market data | Overestimating home value |

| One-size-fits-all | Each home is unique, affecting calculations | Misleading comparisons |

| Instant results are reliable | Timeliness doesn’t guarantee accuracy | Rushed decision-making |

| They replace appraisals | Can’t substitute professional evaluations | Ignoring expert insights |

| All calculators are equal | Quality and algorithms differ | Confusion over reliable tools |

Understanding these points helps you use calculators wisely.

Making Informed Decisions With Calculator Estimates

Maneuvering the landscape of home value calculators requires a strategic approach to interpret the estimates they provide.

While these tools can offer valuable insights, you must consider calculator accuracy and estimate limitations.

Understand that the estimates are based on algorithms and may not account for unique property features or local market conditions.

Cross-reference the calculator’s results with comparable sales data and consult real estate professionals for a more nuanced perspective.

Conclusion

Before relying solely on a home addition value calculator, it’s essential to recognize its limitations. By understanding the factors that influence home value, including location and quality of materials, you can make more informed decisions. Don’t forget to cross-check the calculator’s estimates with recent sales data and seek insights from real estate professionals. This approach will help you gain a clearer picture of your property’s worth, ensuring you maximize your return on investment.